Shareholders more likely to support eco-initiatives if they experience climate disasters

- Support for pro-climate initiatives can rise by as much as 38% is shareholders have first-hand experience of natural disasters

- Shareholders revealed to be more likely to pledge support in spite of risking a decrease in firm value

- But support can be short-lived, with many shareholders pulling support once disasters have passed

“It’s an issue that’s close to my heart”…

… It’s a response you often hear when asking somebody why they have chosen to support a social cause, fundraise for a charity by taking on some seemingly impossible challenge, or generally taking a visible stand for something. Whether civilian, businessman or celebrity. Read any bio on JustGiving for those training for a charity run, or any press release about a public figure stepping up to be patron of a non-profit, and often you’ll find that their reason for choosing to take such action comes from how the issue at hand has impacted their lives, or the lives of their loved ones.

Funnily enough, it seems the same approach can be taken when looking at encouraging shareholders to back climate-focused initiatives in industry.

Rather than the decision purely being based on more boardroom-appropriate rationales such as ROI, reputation or growth, instead, new research indicates that the decision for shareholders to get behind new corporate initiatives designed for social good goes beyond the potential for profitability. It comes from the heart.

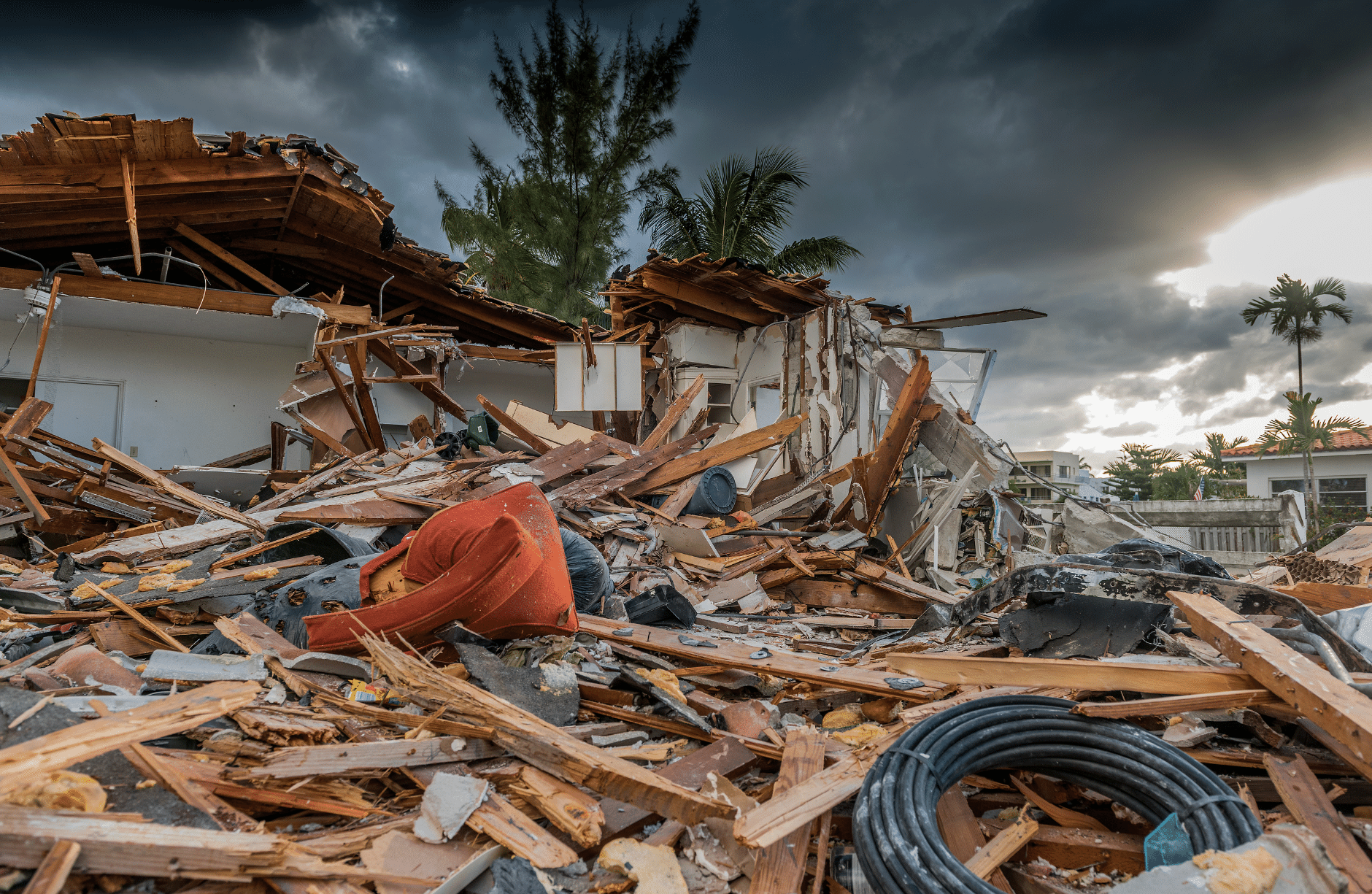

The study, undertaken by Dr Guosong Xu at the Rotterdam School of Management Erasmus University (RSM) alongside Dr Eliezer Fich at Drexel University, revealed that shareholders in locations recently hit by climate-related disasters such as hurricanes are far more likely to support environmental proposals – by as much as 38%.

More surprisingly, shareholders in such locations were more likely to pledge their support even in spite of such proposals risking a decrease in firm value.

Through their work, the researchers sought to answer two key questions at the crux of encouraging corporations to do more to support environmental protection efforts; whether shareholder beliefs about climate change alter their support for environmental proposals, and whether those proposals affect firm value.

“Climate change related proposals have increased steadily in recent years, reflecting growing investor demand for corporate accountability,” says Dr Xu. ”However, despite their popularity, these proposals commonly receive insufficient support. According to a report by the UN, just 2.8% received enough votes to pass during stockholder meetings held from 2006 to 2020.” Through his research, he says, he aims to understand why support is so low and, crucially, what it will take to pass such proposals successfully in future.

The researchers speculated that the significant lack of voting support is driven by the perception that climate-change is not an immediate concern.

To test this, Drs Xu and Fich analysed the mutual funds’ voting records of US firms according to the Institutional Shareholder Services (ISS) Voting Analytics database, between 2006 and 2020. They then mapped each funds headquarters to the Census 2010 county Federal Information Processing Standards (FIPS) code, to identify hurricane locations.

By using these methods, the researchers were able to base their findings on more than 357,000 voting observations made by shareholders of US-based firms… and make several key discoveries as a result.

Firstly, funds in areas hit by a hurricane were significantly more likely to vote for an environmental proposal in the immediate aftermath of the event, as were funds located in other hurricane-prone locations. So striking was the impact of such a climate-related event that the difference in investor support was found to be as much as 38% higher in such locations.

Notably, the researchers say that fund characteristics such as size, performance and flows, or attitudes towards environmental, social and corporate governance (ESG) issues had little impact on their research findings. Those instances where unconditional support for climate proposals was found did not seem to differ among funds located either inside or outside of hurricane-prone locations in the years without a hurricane strike.

Therefore, they conclude, shareholders’ changed perceptions about climate risks were the most likely reason for their increased support for pro-environmental initiatives after a hurricane strike. Belief indeed plays an important role in investor behaviour.

So with that in mind, short of hiring a minibus and driving investors into the path of the nearest hurricane, shouldn’t we at least be sitting them down to watch “An Inconvenient Truth” or the latest sobering series from Sir David Attenborough to sway their perspectives? If only it were that easy. Despite the significant upswing in support recorded by Drs Xu and Fich, the effect was, for many, temporary. The study also recorded that most investors returned to their previous stances and reversed their support for pro-climate within three years. This result is particularly disappointing, but is not entirely unexpected, as previous research by the experts at BI Norwegian Business School discovered not too long ago that people tend to care less about the environment as they get older – which isn’t great news for industry eco-warriors trying to secure the support of their senior investors.

In a further kick, the researchers also noted that once climate-related proposals were passed, firm performance typically weakened. In analysing whether ESG-related proposals created value for firms, the researchers discovered that companies which approved environmental proposals also typically exhibited lower long-term stock returns and accounting underperformance.

It sounds like dismal news all round. But, within this study shines a glaring shred of hope, and an important lesson for us all to learn. Belief is a powerful motivator.

The researchers say their work adds important information to the ongoing debate on the role of corporations in global environmental protection, by highlighting the role of investor psychology in altering shareholders’ perceptions about climate risks and, consequently, their support for corporate environmental policies. If companies can tap into investors’ values and create pro-climate schemes which can both capture shareholder belief systems long-term and provide a measure of social good, we are at least taking a step in the right direction.