Wage Garnishment in the U.S. Is More Common Than You Might Think

BlueSky Thinking Summary

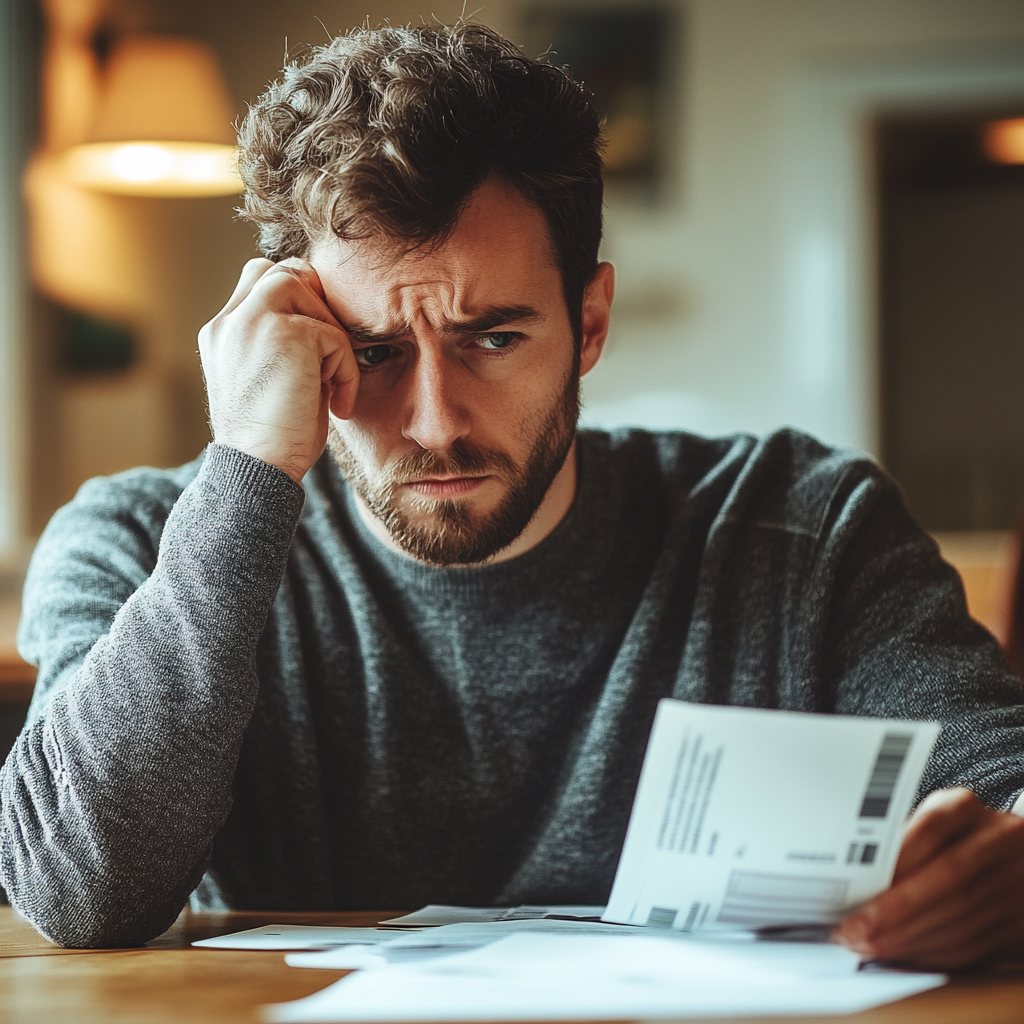

Wage garnishment appears to hit about 1 percent of workers in the United States' private sector at any given time, with an average lost 10 percent of their pay before the tax- an amount about equal to what the average household spends on groceries.

Anthony DeFusco provides in a new working paper the first comprehensive look at this largely hidden practice, drawing on data from the payroll firm ADP.

Research indicates that garnishment periods are relatively short one of 7.6 months on average for garnishments related to student loans and about 4.8 months for other debt types.

A worker being subjected to garnishment is more likely to switch employers in the course of a year, probably to avoid continued deductions.

There are also disparities in the following: Garnishment rates are much higher among less-educated borrowers, minorities, and those living in certain neighborhoods.

It raises questions about systems that would foster such inequalities.

DeFusco emphasizes that much further research is required to have a base for meaningful policy improvements in the protection of workers and refinement of wage garnishment regulations.